[ad_1]

Contract management startup Harbour today announced that it raised $15 million in a Series A funding round that had participation from Getty Images co-founder Jonathan Klein, Scribble Ventures and The Palmer Company.

Bringing Harbour’s total raised to $20 million, the new funds will be put toward growing the startup’s team of 12 and scaling its sales and go-to-market efforts, as well as supporting Harbour’s ongoing engineering and product development.

“The biggest challenge the digital contracting industry will face is continuing to strike the right balance between automation and augmentation as AI becomes a stronger force across all markets,” co-founder and CEO Josh Elkes told TechCrunch in an email interview. “Harbour is built to augment a business’ processes, not replace them. We’ve architected the product to easily integrate with other systems and move contracts through an enterprise from draft to execution as seamlessly as possible.”

Elkes, who co-founded Harbour in 2019 with Eric Doversberger, spent most of his career licensing content at Downtown Music and Getty Images (which likely explains Klein’s involvement). Doversberger spent over 10 years on Google’s people analytics team, for his part.

Josh’s experience in content licensing led him to explore building an automation platform for creating business contracts. He met Doversberger while attending a San Francisco Ballet event with their wives, and the two bonded over their mutual interest in streamlining legal back-office workflows.

“Every time a business uses an image, video or song, it requires one or many contracts,” Elkes said. “As the creator economy rapidly expanded, businesses were looking to work directly with a growing number of creators, but contracting software wasn’t keeping pace with the speed, volume and level of collaboration businesses needed to transact. It was like sending a wire transfer every time you should be using Venmo.”

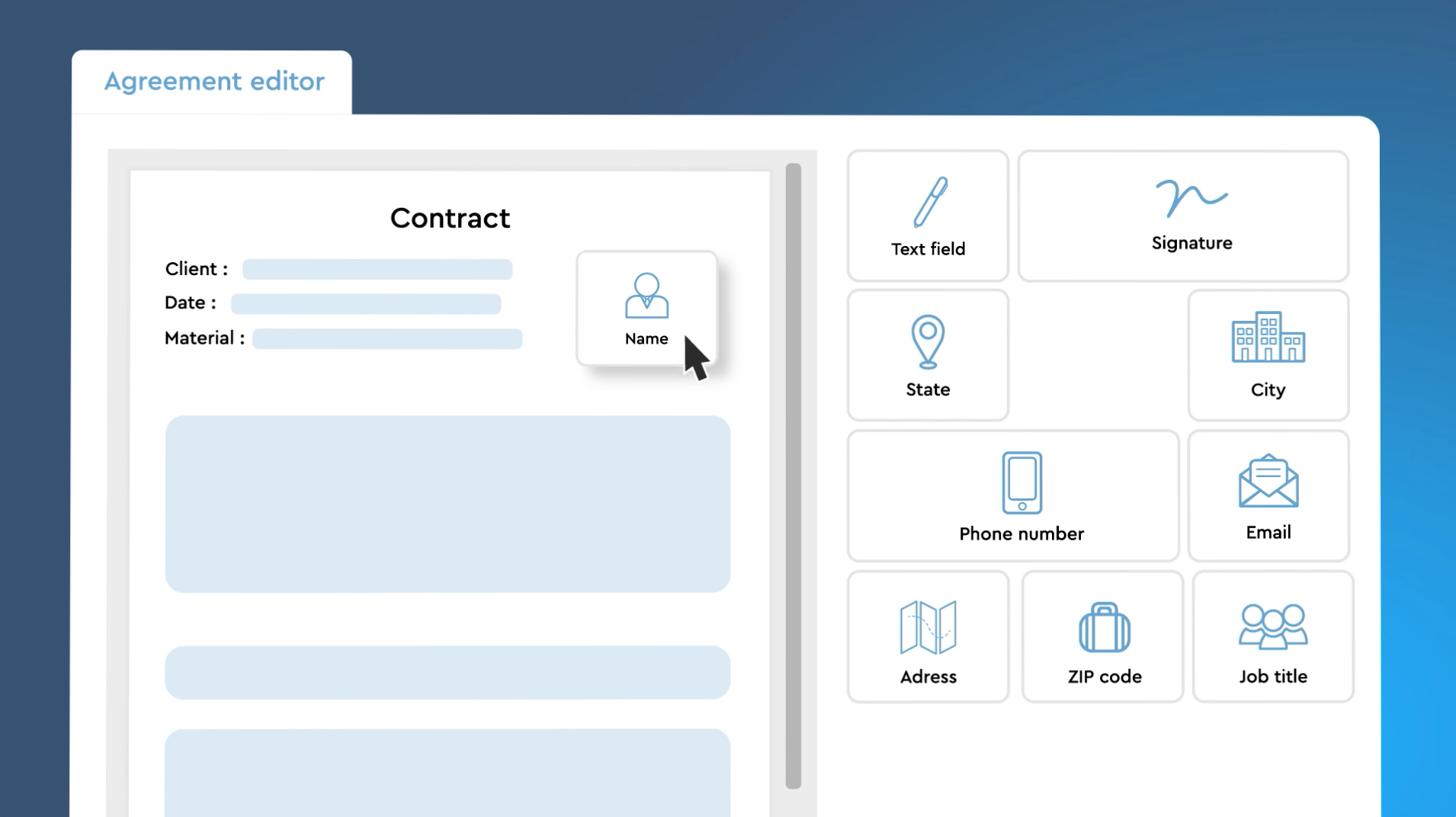

Harbour is essentially a contract lifecycle management (CLM) platform, with modules that are designed to simplify various parts of the contract writing, modification and signing process. Harbour provides ways to redline (i.e. collaborate on a contract edit) and version control contracts as well as templates for contracts, e-signature integration and real-time editing tools.

Beyond this, Harbour — which is embeddable on any website — can be configured to automatically trigger things like background checks and updating customer relationship management records. And it uses AI to better understand an organization’s documents, automating the extraction of actionable company information like key clauses, sending alerts and spotting differences in contactual language that might require additional review.

Harbour can even write and update contractual language autonomously — a somewhat concerning feature, given AI’s tendency to go off the rails. But Elkes emphasized that humans must approve any language the platform suggests.

“Harbour provides the building blocks for creating legal workflows that can live anywhere,” Elkes said. “The entire product, including workflows and contracts, is easily embeddable and can be highly customized to match any aesthetic … Harbour turns agreements into easy-to-share links, which can be sent in a personal email rather than leadership receiving dozens of nearly identical-looking emails to sign.”

Harbour’s tools work to automate steps around writing, editing and finalizing contracts.

Elkes wasn’t willing to disclose Harbour’s exact revenue when asked. But he claims that business has “tripled” every year and now stands above $1 million in annual recurring revenue.

Harbour has an over-2,000-company customer base, which recently grew to include large entertainment companies and government municipalities. And it’s working with household names like Paramount, Lincoln Center and Smartshift, the gig economy platform, to power things like contracting agreements, tax forms and ID and background checks.

VCs certainly see a rich opportunity in tools to manage the contract lifecycle. While a relatively small space compared to, say, the market for customer relationship management ($44.9 billion in 2023), CLM is growing at a rapid clip. Gartner predicts that legal tech spending — which includes CLM — will increase threefold by 2025.

The challenge for Harbour will be continually besting competitors in the burgeoning field. In March, SpotDraft, a CLM automation vendor, raised $26 million in a venture equity deal. Last year, LexCheck, another CLM vendor, landed a $17 million investment. Then there’s larger players like SirionLabs, which has raised a total of $157 million to date, and Icertis, whose warchest is hovering around half a billion dollars.

But Elkes isn’t concerned.

“Since Harbour’s earliest days, it’s run a highly efficient business and kept ‘cash-flow positive’ within its sights,” Elkes said. “It’s a strategic decision to continue investing in growth at this stage, given the size of the market opportunity and optimal timing to bring a next-generation contract management platform to the market.”

[ad_2]

Source link

Comments are closed.