[ad_1]

Receive free Alibaba updates

We’ll send you a myFT Daily Digest email rounding up the latest Alibaba news every morning.

This article is an on-site version of our FirstFT newsletter. Sign up to our Asia, Europe/Africa or Americas edition to get it sent straight to your inbox every weekday morning

Good morning. Belgium’s intelligence service has been monitoring Alibaba’s main logistics hub in Europe for espionage following suspicions Beijing has been exploiting its growing economic presence in the west.

In specific reference to Alibaba’s logistics arm at the cargo airport in Liège, Belgium’s security services told the Financial Times they were working to detect “possible espionage and/or interference activities” carried out by Chinese entities “including Alibaba”.

Alibaba, which denies any wrongdoing, signed an agreement with Belgium in 2018 to open the hub in Liège, Europe’s fifth-largest cargo airport, ploughing €100mn of investment into the ailing economy of the French-speaking Walloon region.

But almost two years on from the site being opened, the Belgian State Security Service (VSSE) has continued monitoring Alibaba’s operations following intelligence assessments, said people familiar with the matter. One area of scrutiny includes the introduction of software systems that collate sensitive economic information.

Here’s the full story on the espionage concerns at Alibaba’s European hub.

-

More on spy scandals: As western governments increasingly call out Russian and Chinese espionage, the risks to travellers in Moscow and Beijing will grow, writes Elisabeth Braw.

And here’s what I’m keeping tabs on today and over the weekend:

-

Monetary policy: Reserve Bank of India is widely expected to keep rates on hold today when it makes its bimonthly monetary policy statement. (Reuters)

-

Summit: EU leaders gathered in Granada are expected to debate the bloc’s effort to boost its “strategic autonomy” by reducing its economic dependence on China.

-

China: Shanghai Fashion Week begins on Sunday.

How well did you keep up with the news this week? Take our quiz.

Five more top stories

1. The head of the IMF has said the “remarkable resilience” of the global economy this year has cut the chances of a painful recession in the coming quarters, even as she warned of weak growth over the next five years. Kristalina Georgieva highlighted “strong momentum” in the US economy and singled out India as a bright spot, saying the odds of a “soft landing” for the global economy had risen as a result.

-

A less rosy view: Mohamed El-Erian argues that the US may no longer avoid a recession, as markets internalise the significant likelihood that rates will stay higher for longer.

2. Chinese developer Sunac has won court approval to restructure around $10bn of debt, marking one of the first resolutions of its kind among China’s distressed real estate companies. The plan, which was set out in March this year after Sunac missed interest payments on a US dollar bond in May 2022, was approved by a high court judge on Thursday at a hearing in Hong Kong. The breakthrough brings some relief to China’s crisis-hit property sector.

3. Sam Bankman-Fried discussed the massive debt owed by his private trading firm Alameda to customers of his FTX cryptocurrency exchange in June 2022, six months before FTX collapsed, according to testimony from one of the disgraced tycoon’s former roommates. “We were bulletproof last year, but we’re not bulletproof anymore,” Adam Yedidia, who had worked at FTX, recalled Bankman-Fried saying. Here’s more from the third day of Bankman-Fried’s trial.

4. A US fighter jet has shot down a Turkish drone in northeastern Syria in what the Pentagon described as a “regrettable incident” that comes at a time of increased tensions between the Nato allies. Pat Ryder, the spokesperson for the Pentagon, said the action had been taken in “self defence” by an F-16 jet, but added that there was no indication that Turkey was targeting US forces. Read the full story.

-

More on Syria: Dozens of Syrians were killed and scores wounded after a drone attack on a military graduation ceremony in central Syria, in one the deadliest attacks against the war-devastated state’s army.

5. Disney will offer free mobile phone streaming of the Cricket World Cup in India, which is expected to attract hundreds of millions of viewers. The US entertainment group has exclusive rights to broadcast the World Cup, and hopes the tournament will give it some momentum in India as it competes for streaming supremacy with Indian billionaire Mukesh Ambani’s JioCinema.

The Big Read

A clash of cultures is happening in the Arizona desert, where Taiwan Semiconductor Manufacturing Company is building its first big manufacturing base in the US. The Taiwanese chip giant has struggled with the American approach to construction and labour, and whether its Arizona project succeeds could make or break the US’s quest to resurrect semiconductor production on its shores. It could also determine if TSMC can transform itself into a true multinational.

We’re also reading . . .

-

Obituary: MS Swaminathan, who has died aged 98, was the architect of India’s green revolution, transforming a chronically hungry nation into one of the world’s largest food producers.

-

Leo Lewis: Japan may be ageing, but in several critical areas, the country’s demographics are aligned to work strongly in favour of companies and investors.

-

London Underground: When Sarah de Lagarde fell on to the Tube tracks, nobody helped. Why? FT Magazine has delved into what happens when the world’s oldest subway system falls behind the rest of the world’s safety measures.

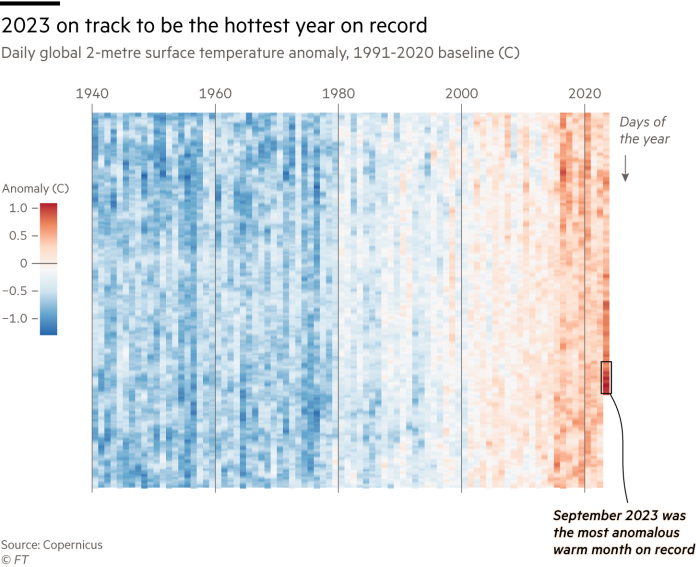

Chart of the day

The world experienced its hottest September ever last month after surpassing the previous record by an “extraordinary” 0.5C, the European earth observation agency said, adding that 2023 was on course to be the hottest on record.

Take a break from the news

Michael Lewis’s Going Infinite traces Sam Bankman-Fried’s journey from friendless nerd to unflappable Wall Street trader, business tycoon and finally accused felon — all by the age of 31. The FT’s Brooke Masters reviews Lewis’s latest book and three others that explore cryptocurrency’s boom and bust.

Additional contributions from Tee Zhuo and Gordon Smith

[ad_2]

Source link

Comments are closed.