[ad_1]

Receive free World updates

We’ll send you a myFT Daily Digest email rounding up the latest World news every morning.

This article is an on-site version of our FirstFT newsletter. Sign up to our Asia, Europe/Africa or Americas edition to get it sent straight to your inbox every weekday morning

Good morning.

We start this morning with a JPMorgan Chase scoop. The bank has stepped up the pace at which it is securitising billions of dollars of its loan portfolio in anticipation of proposed new US capital requirements for large banks, according to people familiar with the matter.

The bank plans to securitise and sell loans from its Chase retail business, including mortgages, auto lending and credit card loans, these people said.

Securitisation — the process of pooling loans into a tradable, interest-bearing security — is just one tool that is being using to reduce its risk-weighted assets, one of the people familiar with the matter said.

The Federal Reserve came out with a proposal in July that would increase the amount of capital banks have to hold relative to their risk-weighted assets, a ratio that has already risen considerably since the 2008 financial crisis.

Under the new rules, lenders would be required to hold an extra $2 of capital for every $100 of risk-weighted assets. JPMorgan chief executive Jamie Dimon has criticised regulators over the proposals, warning that they risked making bank stocks uninvestable. Read more on JPMorgan’s plan to securitise its loan book.

Here’s what I’m keeping tabs on today:

-

Results: ConAgra, maker of consumer packaged foods such as Slim Jim beef jerky sticks and Reddi-wip whipped cream, is expected to post a small increase in quarterly revenue due to higher prices for its goods.

-

Economic data: Initial US state unemployment claims, a proxy for lay-offs, are expected to have ticked up last week.

-

Monetary policy: Michael Barr, the Federal Reserve’s vice-chair for supervision, will speak about cyber risk in the banking sector at a conference hosted by the Cleveland Fed.

-

EU: Ukrainian President Volodymyr Zelenskyy has arrived in Granada, Spain, for a summit of European leaders as concerns grow on the continent about the flow of US military aid to the war-torn country.

Five more top stories

1. Oil prices are steady this morning after plunging by more than $5 a barrel yesterday. Brent crude, the international benchmark, was trading at $85.90 a barrel, slightly above the $85.81 closing price in New York following the biggest one-day drop since August 2022. West Texas Intermediate, the US marker, rose 7 cents a barrel to $84.29 in European trading. Our blog has the latest prices.

2. Jim Jordan, founding member of the rightwing House Freedom Caucus and loyal ally of former US president Donald Trump, yesterday became the first Republican lawmaker to enter the race to succeed Kevin McCarthy, the ousted Speaker. He was followed by Steve Scalise, the House majority leader and representative from Louisiana. Here’s more on the lawmakers hoping to become the Republicans’ new leader in Washington.

3. The rightwing-dominated body charged with writing Chile’s new constitution has approved a draft that enshrines conservative positions into law, including curbing the right to strike and protecting the right to life of the unborn. The new constitution is unlikely to receive the backing of voters, according to opinion polls. Last year voters rejected a radical document drafted largely by leftwing politicians. Read more on Chile’s constitutional rewrite.

4. Belgium’s intelligence service has been monitoring Alibaba’s main logistics hub in Europe for espionage activities as the continent reassesses its traditional openness to trade with China. Alibaba, which denies any wrongdoing, signed an agreement with Belgium in 2018 to open the hub in Liège, Europe’s fifth-largest cargo airport. But two years after the site was opened security services continue to monitor Alibaba’s operations. Here’s more on what the Belgian authorities are concerned about.

5. Russia is scrambling to cover the ballooning cost of its war in Ukraine, with Vladimir Putin’s cabinet turning to increasingly irregular revenue-raising measures. The Kremlin has said it aims to spend Rbs10.8tn ($108bn) on defence next year, three times the amount allocated in 2021, before the invasion. Here’s how Moscow plans to cobble together the staggering sum.

News in-depth

A sell-off in global bond markets has pushed borrowing costs to their highest levels in a decade or more, raising fears that the recent sharp moves could inflict severe damage on various parts of the financial system. This includes potentially heavy losses for banks, insurers, pension funds and asset managers that own trillions of dollars of sovereign and corporate debt after loading up in recent years. Here’s how they will be affected.

We’re also reading . . .

-

America’s growing isolationism: The ousting of Kevin McCarthy as Republican speaker is bad news for Ukraine, argues Edward Luce.

-

US economy: The US may no longer avoid a recession, says Mohamed El-Erian, after an impressive period of growth.

-

Semiconductors: Unfamiliar approaches to construction and labour are proving obstacles to Taiwanese chip giant TSMC’s massive US project in the Arizona desert.

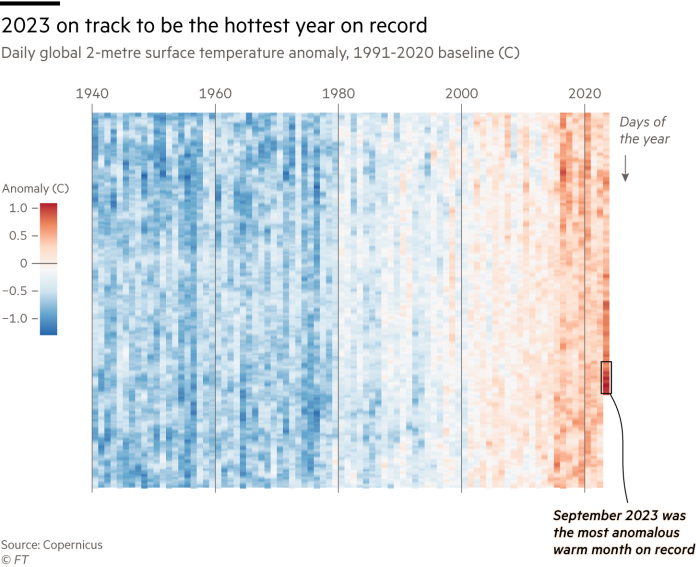

Chart of the day

The world experienced its hottest September ever last month after surpassing the previous record by an “extraordinary” 0.5C, the European earth observation agency said. Samantha Burgess, deputy director of the Copernicus Climate Change Service, said the “extreme month” had probably pushed 2023 into the “dubious honour of first place” as the hottest year ever, with temperatures about 1.4C above pre-industrial average temperatures. Here’s more of the findings.

Take a break from the news

A dozen years ago the FT’s editor at large in the US, Gillian Tett, began writing a column for the weekend magazine. Later this month she is moving on to become the provost of King’s College in Cambridge. In her final column she writes of the three lessons that she will take away from writing a weekly opinion piece.

Additional contributions from Tee Zhuo and Benjamin Wilhelm

[ad_2]

Source link

Comments are closed.