[ad_1]

This article is an on-site version of our FirstFT newsletter. Sign up to our Asia, Europe/Africa or Americas edition to get it sent straight to your inbox every weekday morning

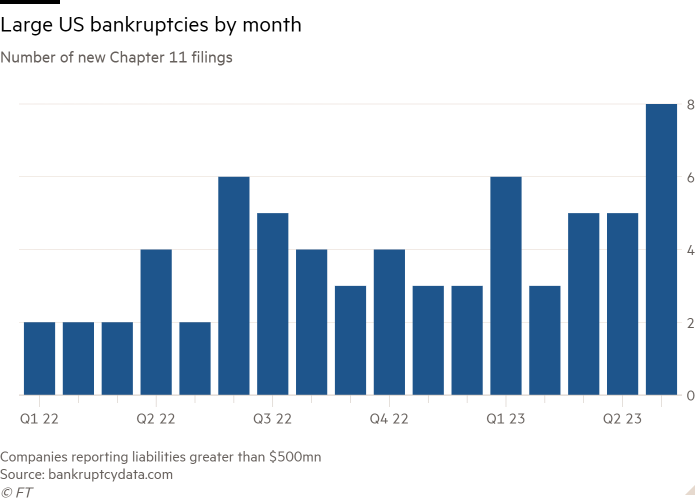

More large US companies are taking shelter in bankruptcy court, a sign of a tightening credit squeeze as interest rates rise and financial markets become less hospitable to borrowers.

Eight companies with more than $500mn in liabilities have filed for Chapter 11 bankruptcy this month, including five in a single 24-hour stretch last week. In 2022 the monthly average was just over three filings.

Twenty-seven large debtors have filed for bankruptcy so far in 2023 compared with 40 for all of 2022, according to figures compiled by bankruptcydata.com.

Recent companies to succumb to creditors include Envision Healthcare, Vice Media and Kidde-Fenwal, a maker of fire control systems facing thousands of lawsuits over its use of so-called forever chemicals.

S&P Global forecasts that the 12-month trailing default rate for speculative-grade securities will jump from the current 2.5 per cent to 4.5 per cent by early 2024.

Here’s what I’m watching today and over the weekend:

-

Jamie Dimon questioned: The JPMorgan Chase chief executive is set to answer questions under oath today about his knowledge of Jeffrey Epstein’s crimes.

-

Economic data: The Federal Reserve’s preferred measure of inflation — the core personal consumption expenditures price index — is updated today as is the Census Bureau’s measure of durable goods purchases and the University of Michigan’s consumer sentiment index.

-

Elections: Voters head to the polls on Sunday for the presidential election run-off in Turkey. Incumbent Recep Tayyip Erdoğan faces opposition leader Kemal Kılıçdaroğlu.

Five more top stories

1. The White House and Republicans in Congress are moving closer to a deal to increase the debt ceiling ahead of the long weekend. The deal under discussion would limit most government spending until 2025, said people close to the discussions.

2. Carl Icahn secured a much-needed victory yesterday when shareholders of Illumina backed his nomination to be chair of the world’s biggest gene sequencing company. However, two of the activist investor’s other nominations for the board failed to win seats, paving the way for the re-election of the company’s chief executive and another director. Illumina shares fell 11 per cent after the results were announced.

3. The head of OpenAI has said his service could stop operating in Europe if current plans by the EU to regulate artificial intelligence are introduced. The EU’s AI act is due to be finalised next year and has been expanded to include general purpose AI technology, such as OpenAI’s GPT-4. Read more on Sam Altman’s warning.

4. Three big European insurers and a Japanese one are the latest to leave a high profile initiative to tackle climate change. Mark Carney’s Glasgow Financial Alliance for Net Zero was launched with great fanfare at the COP26 in Glasgow in 2021 but has come under attack from Republican politicians in the US. Read more

5. Ford has struck a deal to give its drivers access to 12,000 fast-charging stations in Tesla’s network. The agreement more than doubles the number of fast-charging stations in Ford’s North American charging network and is an attempt to combat the range anxiety that discourages consumers from buying an EV.

How well did you keep up with the news this week? Take our quiz.

News in-depth

An analysis by the Financial Times has given further proof to what many in the City already fear: London is the European stock exchange most at risk of suffering big departures to the US. Among the 111 European companies assessed, London listings make up half of the top 10. See the full listing here.

We’re also reading . . .

-

Netflix: The streaming platform’s move to crack down on password sharing is a necessary risk in tackling its 100mn freeloaders, writes Christopher Grimes.

-

Law: Read the profile of the Belgian-born leader of Allen & Overy who is the driving force behind one of the largest mergers ever seen in the legal industry.

-

Ukraine war: Jean-Yves Ollivier, a cigar-chomping French dealmaker, is brokering an improbable African diplomatic mission to help end the war in Ukraine.

Chart of the day

What’s going on with US car insurance? The share price of two of the largest US car insurance companies — Take Allstate and Progressive — have fallen in the past month, reflecting the rising costs of underwriting auto insurance policies. Alexandra Scaggs explains why.

Take a break from the news

The Cannes film festival is due to end tomorrow. Read the reviews of our critic who has been at the French resort and watched the latest offerings from Martin Scorsese, Jonathan Glazer and more.

Additional contributions by Tee Zhuo and Emily Goldberg

[ad_2]

Source link

Comments are closed.