[ad_1]

Good morning. This article is an on-site version of our FirstFT newsletter. Sign up to our Asia, Europe/Africa or Americas edition to get it sent straight to your inbox every weekday morning

After blocking Microsoft’s $75bn takeover of Activision Blizzard last week, the UK competition watchdog is now training its sights on the artificial intelligence market with a review of the so-called foundational models behind popular chatbots such as ChatGPT.

In an interview with the Financial Times, Competition and Markets Authority chief Sarah Cardell said the regulator would assess “the real opportunities there” but also “what kind of guardrails, what principles, we should be developing in terms of ensuring that competition is working effectively [and] consumers are being protected”.

AI has been a rare bright spot for technology innovation in the UK, partly due to the success of DeepMind, a homegrown start-up acquired by Google in 2014.

The review comes as regulators around the world are increasing scrutiny of generative AI, with the US Federal Trade Commission this week saying it was “focusing intensely on how companies may choose to use AI technology, including new generative AI tools, in ways that can have actual and substantial impact on consumers”.

The chief executives of AI companies, including Google, Microsoft and ChatGPT maker OpenAI, are also due to meet US vice-president Kamala Harris today to discuss the safety of their products.

-

Opinion: AI experts and lawmakers would benefit from a deeper understanding of each other, writes Marietje Schaake, international policy director at Stanford University’s Cyber Policy Center.

Here’s what else is happening today:

-

UK local elections: Rishi Sunak faces his first big electoral test since becoming prime minister as more than 8,000 seats on 230 local councils are at stake.

-

Results: Adecco, Anheuser-Busch InBev, Apple, ArcelorMittal, Bertelsmann, BMW, ConocoPhillips, Ferrari, Hyatt Hotels, Jones Lang LaSalle, Kellogg, Moncler, Novo Nordisk, Shell, Swiss Re, Veolia, Virgin Money UK and Volkswagen report.

-

Economic data: S&P Global publishes its services purchasing managers’ indices for the UK, the EU, France, Germany, Italy and Spain.

We just relaunched our Working It newsletter with a new section where editor Isabel Berwick will answer all of your office dilemmas. Sign up here and stay one step ahead at your workplace.

Five more top stories

1. Exclusive: Vodafone and CK Hutchison are close to agreeing a £15bn deal to combine their UK telecoms businesses that would create the country’s biggest mobile operator with 28mn customers, three people close to the matter said. Read more about the historic consolidation of the UK market.

2. PacWest shares plummeted 50 per cent in after-hours trading yesterday after the California lender started exploring strategic options including a sale. The move comes just days after First Republic was sold to JPMorgan Chase and makes PacWest the latest midsized US bank to seek a financial lifeline.

3. The sale of First Republic to JPMorgan has been criticised by veteran regulator Bill Isaac, who is credited with stabilising the US banking system during the 1980s savings and loan crisis. Here’s why the former head of the Federal Deposit Insurance Corporation believes the regulator’s decision was misguided.

4. AstraZeneca is paying its chief executive enough to stop him from quitting for lucrative US roles, its new chair Michel Demaré said in defence of the drugmaker’s decision to increase the size of Pascal Soriot’s bonus despite shareholder criticism. Read the full interview with Demaré.

-

CEO pay: The country’s executives should be paid more if the UK wants to retain talent and stop companies from moving abroad, said the head of the London Stock Exchange.

5. Exclusive: The European People’s party plans to call for scrapping flagship green legislation put forward by European Commission president Ursula von der Leyen. Europe’s largest political party joins a growing backlash against Brussels’ plan, arguing that it threatens food production and farmers’ livelihoods.

Deep dive

Embarking on a career in finance at a Wall Street bank in Paris might once have been regarded as a consolation prize for those who had failed to find a job in New York, London or Hong Kong. Today, the French capital is shaking off its “backwater office” tag and gaining momentum as a financial hub, but it still lags behind London in size.

We’re also reading . . .

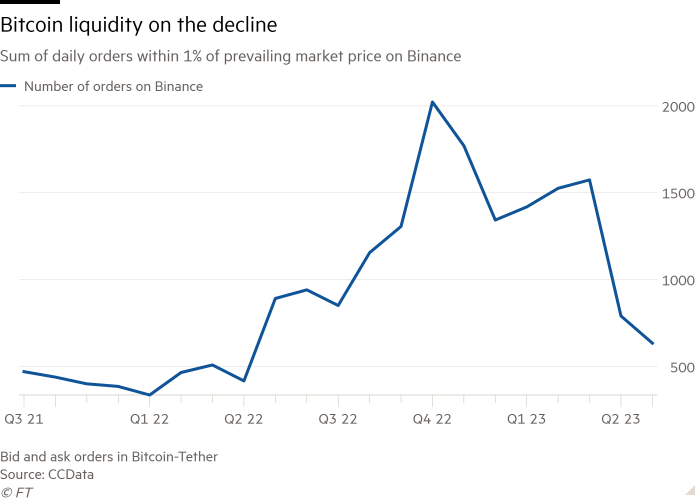

Chart of the day

Cryptocurrency trading activity has dwindled even as bitcoin enjoys its longest winning streak in more than two years, in a sign that many investors are increasingly reluctant to buy into the rebound after a string of collapses and scandals in 2022.

Take a break from the news

Amid some amusement and much scorn, it was announced that this weekend’s coronation of King Charles would offer an exciting moment of participation for everyone watching at home, when they would be encouraged to join in with an oath to the new monarch that ends with: “So help me God.” Robert Shrimsley offers some alternative pledges.

Additional contributions by Gordon Smith and Emily Goldberg

Thank you for reading and remember you can add FirstFT to myFT. You can also elect to receive a FirstFT push notification every morning on the app. Send your recommendations and feedback to firstft@ft.com

[ad_2]

Source link

Comments are closed.