[ad_1]

Eurozone business activity expanded faster than expected in April, driven by buoyant demand, easing price pressures and rapid employment growth that economists said would push the European Central Bank to raise interest rates next month.

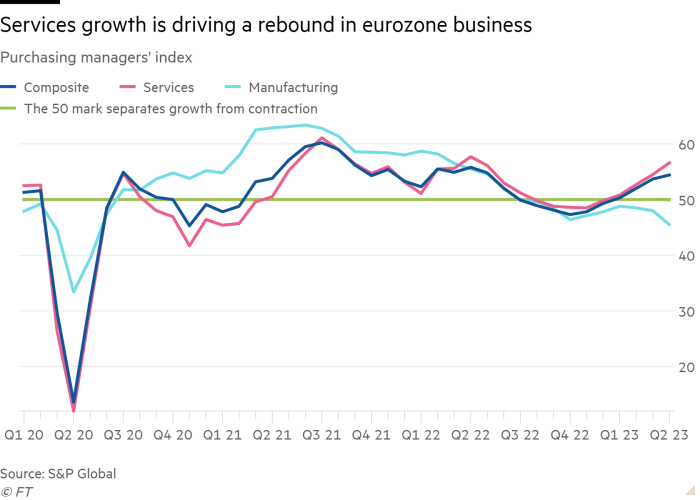

The HCOB flash eurozone composite purchasing managers’ index, a measure of activity in manufacturing and services, rose for the sixth consecutive month to an 11-month high of 54.4 in April, up from 53.7 last month.

The result was above the flat reading forecast by economists polled by Reuters, and indicated that last month’s turmoil in the banking sector failed to halt the economic rebound in the bloc from 2022’s energy shock.

The survey compiled by S&P Global also pointed to a rising divergence between a downturn in the manufacturing sector — particularly in strike-hit France — and a solid resurgence in the bigger services sector.

Cyrus de la Rubia, chief economist at Hamburg Commercial Bank, said beyond the overall “very friendly picture” of business activity, growth was “very unevenly distributed” between “partly booming” services and a “weakening manufacturing sector”.

New orders expanded at the fastest rate for a year in services but declined at the steepest rate for four months in manufacturing. Job growth in the services sector accelerated to the fastest rate for 15 years, while manufacturing employment rose at the slowest rate for 27 months.

While companies continued to raise their prices, the pace of increase is becoming more modest. An index for “selling prices” fell to its lowest level in two years. Services companies, boosted by strong demand, were able to report “especially strong” increases in the prices they charged, in contrast to more modest rises from manufacturers.

“Continued fast price increases, a still-resilient labour market and signs the economy is weathering interest rate hikes and tightening lending standards well, raise the chances that the ECB will tighten more than we expect,” said Melanie Debono, an economist at research group Pantheon Macroeconomics.

Germany’s two-year borrowing costs, which are sensitive to interest rate expectations, rose after the PMI survey was published and the euro recouped some losses against the US dollar.

Investors are pricing in a rise in the ECB’s deposit rate from 3 per cent to above 3.75 per cent in the coming months. Several ECB rate-setters have said the decision on whether it continues raising rates by half a percentage point or slows to a quarter point rise next month will depend on data, including the central bank’s survey of lenders and April’s inflation — both due early next month.

Official figures to be published next Friday are expected to show the eurozone economy returned to positive quarter-on-quarter growth with a 0.2 per cent expansion in the first three months of the year, compared with a flat end to last year.

Rory Fennessy, an economist at research group Oxford Economics, said: “The April flash PMIs pose further upside risks to our near-term GDP forecasts across the region.” But rising borrowing costs still pointed to a “weaker outlook” in the second half of the year, he said.

[ad_2]

Source link

Comments are closed.