[ad_1]

The SEC has been busy, meeting with all of the potential issuers of spot Bitcoin ETFs with active applications in December. These meetings have resulted in the universal adoption of a cash creation methodology by those issuers instead of “in kind” transfers, as is typical for other ETFs. Much has been said about this change, ranging from the absurd to the serious. The TLDR, however, is the overall impact will be minimal to investors, relatively meaningful to the issuers and it reflects poorly on the SEC overall.

In order to provide context, it is important to describe the basic structure of Exchange Traded Funds. ETF issuers all engage with a group of Authorized Participants (APs) that have the ability to exchange either a predefined amount of the funds assets (stocks, bonds, commodities, etc) or a defined amount of cash or a combination of both, for a fixed amount of ETF shares for a predetermined fee. In this case, were “in kind” creation to be allowed, a fairly typical creation unit would have been 100 Bitcoin in exchange for 100,000 ETF shares. With cash creation, however, the Issuer will be required to publish the cash amount, in real time as the price of Bitcoin changes, to acquire, in this example, 100 Bitcoin. (They also must publish the cash amount that 100,000 ETF shares can be redeemed for in real time.) Subsequently the issuer is responsible for purchasing that 100 Bitcoin for the fund to be in compliance with its covenants or selling the 100 Bitcoin in the case of a redemption.

This mechanism holds for all Exchange Traded Funds, and, as can be seen, means that the claims that cash creation means the fund wont be backed 100% by Bitcoin holding is wrong. There could be a very short delay, after creation, where the Issuer has yet to buy the Bitcoin they need to acquire, but the longer that delay, the more risk the issuer would be taking. If they need to pay more than the quoted price, the Fund will have a negative cash balance, which would lower the Net Asset Value of the fund. This will, of course impact its performance, which, considering how many issuers are competing, would likely harm the issuers ability to grow assets. If, on the other hand, the issuer is able to buy the Bitcoin for less than the cash deposited by the APs, then the fund would have a positive cash balance, which could improve fund performance.

One could surmise, therefore, that issuers will have an incentive to quote the cash price well above the actual trading price of Bitcoin (and the redemption price lower for the same reason). The problem with that, is the wider the spread between creation and redemption cash amounts, the wider the spread that APs would likely quote in the market to buy and sell the ETF shares themselves. Most ETFs trade at very tight spreads, but this mechanism could well mean that some of the Bitcoin ETF issues have wider spreads than others and overall wider spreads than they may have had with “in kind” creation.

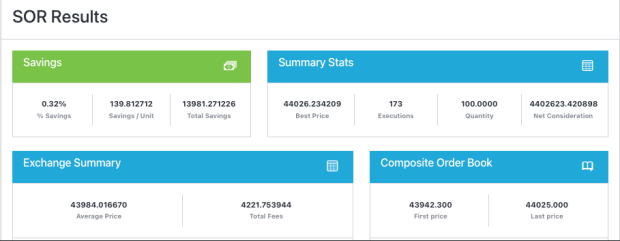

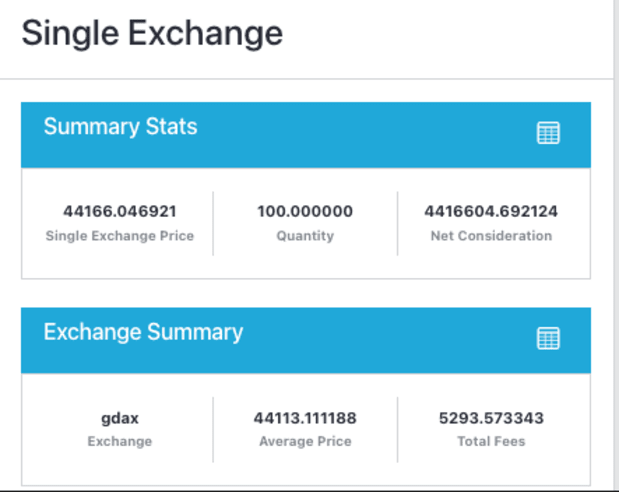

Thus, the issuers have to balance the goal of quoting a tight spread between creation and redemption cash amounts with their ability to trade at or better than the quoted amounts. This requires, however, access to sophisticated technology to achieve. As an example of why this is true, consider the difference between quoting for 100 Bitcoin based on the liquidity on Coinbase alone, vis a vis a strategy that uses 4 exchanges that are regulated in the U.S. (Coinbase, Kraken, Bitstamp and Paxos). This example used CoinRoutes Cost Calculator (available by API) which shows both single exchange or any custom group of exchanges cost to trade based on full order book data held in memory.

In this example, we see that a total purchase price on Coinbase alone would have been $4,380,683.51 but the price to buy across those 4 exchanges would have been $4,373,568.58, which is $7,114.93 more expensive. That equates to 0.16% more expense to buy the same 100,000 shares in this example. This example also shows the technology hurdle faced by the issuers, as the calculation required traversing 206 individual market/price level combinations. Most traditional financial systems do not need to look beyond a handful of price levels as the fragmentation in Bitcoin is much larger.

It is worth noting that it is unlikely the major issuers will opt to trade on a single exchange, but it is likely that some will do so or opt to trade over the counter with market makers that will charge them an additional spread. Some will opt to use algorithmic trading providers such as CoinRoutes or our competitors, which are capable of trading at less than the quoted spread on average. Whatever they choose, we do not expect all the issuers to do the same thing, meaning there will be potentially significant variation in the pricing and costs between issuers.

Those with access to superior trading technology will be able to offer tighter spreads and superior performance.

So, considering all of this difficulty that will be borne by the issuers, why did the SEC effectively force the use of Cash Creation/Redemption. The answer, unfortunately, is simple: APs, by rule are broker dealers regulated by the SEC and an SRO such as FINRA. So far, however, the SEC has not approved regulated broker dealers to trade spot Bitcoin directly, which they would have needed to do if the process was “in kind”. This reasoning is a far more simple explanation than various conspiracy theories I’ve heard, that do not deserve to be repeated.

In conclusion, the spot ETFs will be a major step forward for the Bitcoin industry, but the devil is in the details. Investors should research the mechanisms each issuer chooses to quote and trade the creation and redemption process in order to predict which ones might perform best. There are other concerns, including custodial processes and fees, but ignoring how they plan to trade could be a costly decision.

This is a guest post by David Weisberger. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.

[ad_2]

Source link

Comments are closed.