[ad_1]

After a historically-bad year for bitcoin mining, public companies that fell into penny stock status surged back in January following a strong bitcoin rally.

2022 was arguably the worst year on record for bitcoin mining. Every market suffered from the consequences of unprecedented recklessness by central banks around the world. But because bitcoin is nothing if not volatile — and because mining acts as a leveraged bet on bitcoin itself — the mining sector of the bitcoin economy finished last year battered and bruised. In fact, many public mining companies were relegated to trading as literal penny stocks.

Thanks to an unexpected, wildly-bullish start to the new year, however, investors have seen bitcoin mining stocks roar back to life. No doubt the relief in share prices (and the price of bitcoin itself) is welcome. How long this rally will last, though, is an open question.

This article summarizes the state of bitcoin mining at the beginning of this new year, the tragedies left behind in the previous year and the opportunities that lay ahead.

New Year Mining Rally

2023 started with a bang for publicly-traded bitcoin mining companies.

Year to date, companies like Riot Platforms, Marathon Digital and CleanSpark have all gained between 40% to 110%, according to market data from TradingView. These share price surges are in large part due to a sustained rally in bitcoin’s price. Since New Year’s Day, the leading cryptocurrency has gained over 44%. As a result, mining economics are also improving. Hash price has jumped 25% even as hash rate (which, when it increases, normally causes hash price to fall) set new all-time highs in January.

Across the board, bitcoin miners ended 2022 on a very bearish note, however. As noted above, a lot of them traded as literal penny stocks by the holidays.

A Rundown On Penny Stocks

Penny stocks intuitively suggest securities that trade at market prices of mere pennies. And, in fact, many bitcoin mining companies saw share prices drop to pennies. But officially, the definition of penny stocks refers to the stock of a small company that trades for less than $5 per share. Penny stocks can trade on large exchanges like Nasdaq, which has listed many bitcoin mining companies. But most of them trade via over-the-counter (OTC) transactions.

Several bitcoin mining companies would have been lucky to see share prices above $5 by the end of last year, though. The data in the following sections shows that, after soaring to multi-billion-dollar market capitalizations, not a few but many mining companies had shares trading below a single dollar.

Bitcoin Mining Penny Stocks Data

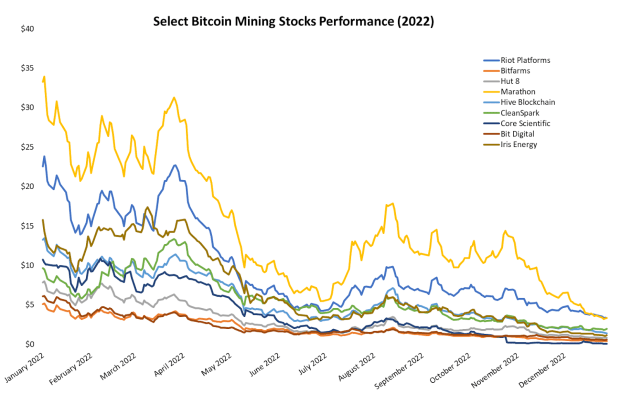

Bitcoin fell by roughly 65% in 2022. Despite not being the worst bear market drawdown on record for bitcoin itself, miners were not as lucky. The line chart below shows real share prices for a select group of leading mining companies for the duration of 2022. Even a quick glance at the visual will recognize a common theme: down… a lot.

The worst came last for these poor companies. At the very end of 2022, nearly a dozen companies saw their share prices drop below one dollar. The following list is composed of bitcoin mining companies that traded below $1 by the end of last year.

- Core Scientific: $0.20

- Hut 8: $0.87

- TeraWulf: $0.58

- Mawson: $0.28

- Digihost: $0.47

- BIT Mining: $0.20

- Argo: $0.44

- Cipher: $0.62

- Bit Digital: $0.56

- Greenidge: $0.37

- Stronghold: $0.46

After reviewing all of the above data, you might ask: Do bitcoin mining share prices even matter? Obviously not for the long-term success of Bitcoin. But the public mining sector does reflect on Bitcoin itself to a non-trivial degree. The mess of unwinding bull market risk taking, greed and general excess is not pleasant. Hopefully, the worst is over.

The Road To Pink Slips

How did the once-booming public bitcoin mining sector fall to penny stock status?

After surging to a total market value of over $100 billion, bitcoin mining companies crashed hard. This effect is somewhat unavoidable when bitcoin itself is crashing. The business of mining is expensive, capital intensive and highly competitive. When market conditions are anything but perfect, heads start metaphorically rolling.

Also, it is worth noting that the macroeconomic headwinds facing every market effectively killed all technology markets around the world. Bitcoin mining had no chance of escaping the bloodshed. Meta, for example, was the worst performer in the Standard and Poor’s 500 index last year. Apple, which dominates the weighting of the same S&P 500 index at roughly 6%, also ended last year down sharply.

But, beyond the macroeconomic landscape, bitcoin miners are not immune to greed and reckless business decisions. A substantial portion of the public mining hash rate growth and mining company valuations were directly tied to overleveraged investors and operators making risky bets in the same style as other “crypto” companies did, which have now gone bankrupt. Miners becoming penny stocks or filing for bankruptcy is the result of the same quality of choices.

New Year, Old Miners

Many new mining teams that entered the market over the past few years did not make it to 2023. But every miner that survived the past year is now a hardened veteran. Is the bear market over? Nobody knows. But in the face of bankruptcies, lawsuits, executive departures, delistings and more, miners who are still hashing today can likely keep hashing through anything.

Hopefully, lessons from the greed and degeneracy of the last bull market will not be quickly forgotten, but this author won’t be holding his breath.

This is a guest post by Zack Voell. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.

[ad_2]

Source link

Comments are closed.