[ad_1]

This article is an on-site version of our Disrupted Times newsletter. Sign up here to get the newsletter sent straight to your inbox three times a week

Today’s top stories

-

BlackRock is buying Global Infrastructure Partners for $12.5bn in a deal that creates the world’s second-biggest infrastructure firm and shakes up private market investing. BlackRock, already the world’s biggest money manager, said assets under management had surged above $10tn for the first time since 2021.

-

In other Wall Street updates, Citigroup said it would cut 20,000 jobs after its worst quarter in 15 years; JPMorgan Chase reported record annual profits thanks to high interest rates; Morgan Stanley will pay $249mn to settle with US regulators over block trading charges; Bank of America final quarter profits fell nearly 60 per cent thanks to a charge tied to last year’s regional banking crisis; and earnings at Wells Fargo jumped 9 per cent, despite an increase in loan loss provisions.

-

China’s military vowed to “smash” any Taiwan independence “plots”, sending a stark reminder of its threat to use force against the island just hours before Taiwanese voters head to the polls to elect a new president and parliament.

For up-to-the-minute news updates, visit our live blog

Good evening.

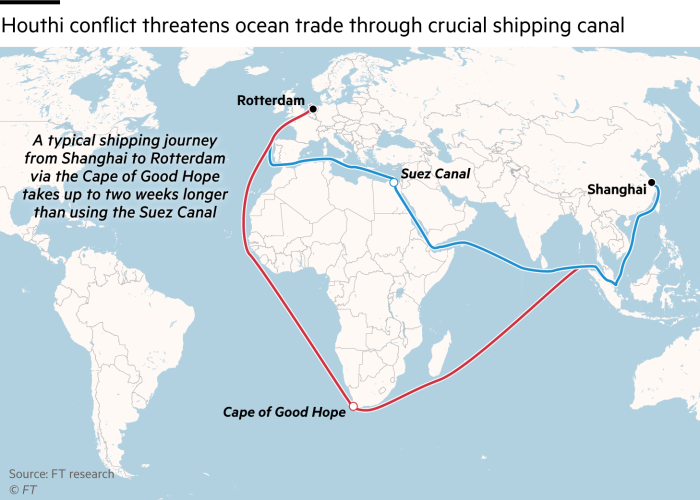

US and UK military strikes against Iran-backed Houthi rebels have fuelled concerns of an escalation of conflict in the region and serious disruption to the global economy through higher oil prices and the flow of goods on one of the world’s most important trade routes.

The action was ordered by US President Joe Biden after “unprecedented” attacks by the Yemen-based militants on commercial ships in the Red Sea. You can read more here about the Houthis’ background and learn more about the possibilities of the conflict widening in the Rachman Review podcast but as for the impact on the world economy, alarm bells are already ringing.

Crude prices have risen, with one analyst commenting: “The fear in the oil market is that the region is on an unpredictable escalating path where at some point down the road supply of oil will indeed in the end be lost.”

Markets were already jittery after Iran yesterday seized an oil tanker off the coast of Oman, just south of the Strait of Hormuz on the other side of the Arabian peninsula, the world’s most important oil shipping route.

The disruption to trade is the most severe since the Covid-19 pandemic and has raised the costs of moving goods by sea to the highest levels recorded outside that period.

Some shippers are turning to air freight, driving up prices: the average cost to fly 1kg of cargo from the Middle East to Europe has increased 35 per cent in the last month.

For freight still moving by sea, diversions mean journeys are far longer, putting supply chains at risk for industries such as electronics and cars: Tesla has already suspended production at its Berlin plant.

Container shipping lines started diverting around the Cape of Good Hope in November when Houthi rebels first began attacking ships on their way to and from the Suez Canal. Services between Asia and Europe are most affected, although some from Asia to the US east coast have also been hit.

At the same time there have been big cuts to the capacity of the Panama Canal, another key route between Asia and the US east coast, thanks to a drought that has lowered water levels.

Freight rates have not yet risen enough to affect consumer prices but that could change, as Bank of England governor Andrew Bailey told MPs this week. He highlighted the risk of higher shipping costs driving inflation back up.

Vincent Clerc, head of shipping giant AP Møller-Maersk, speaking to the Financial Times yesterday before the US and UK strikes, said it could take months to reopen the Red Sea route, risking an economic and inflationary hit to the global economy.

Clerc’s voice carries weight: Maersk is seen as a bellwether of global trade, carrying about a fifth of ocean freight. But whether the crisis heralds a severe blow to globalisation is doubtful, argues FT senior trade writer Alan Beattie. Barring a huge escalation in the conflict, supply chains, for the moment at least, appear to have enough slack to absorb the extra strain.

Need to know: UK and Europe economy

The UK economy bounced back more than expected in November with growth of 0.3 per cent, lifted by the services sector, strong Black Friday sales and fewer strikes. London mayor Sadiq Khan has highlighted new research suggesting the economy is £140bn smaller because of Brexit and has 1.8mn fewer jobs — a drop of 4.8 per cent — than it would otherwise have had. Official statistics show UK life expectancy has fallen to 2010 levels.

The UK is to publish a set of tests that need to be met to pass new laws on artificial intelligence rather than creating a tougher regulatory regime.

A compromise between Brussels and Hungary has produced a four-year aid package for Ukraine. The UK is also increasing funding. Concerns have been raised in the US about the possible diversion of military aid from Kyiv. A new analysis showed Russia was importing a third of its battlefield tech from western companies.

Need to know: Global economy

Annual US inflation rose more than expected to hit 3.4 per cent in December, dimming expectations that interest rates might start falling as soon as March. Producer price inflation however fell unexpectedly. The FT editorial board said President Joe Biden’s team had a good record on the economy but needed to do more to address voters’ anxieties.

Inflation in China, the world’s second-largest economy, on the other hand, is still in deflationary territory. Consumer prices fell for the third month in a row, decreasing 0.3 per cent. Hongkongers are increasingly flocking to mainland China on weekend trips, lured by cheaper groceries and American-style wholesale warehouses.

The president of Ecuador said the country was at war with drug gangs amid a deteriorating security crisis that included jailbreaks, bombings and the temporary takeover of a television studio.

The IMF agreed to release $4.7bn to Argentina despite the country’s failure to meet the terms of a $43bn loan, handing a crucial lifeline to new President Javier Milei as he pursues ambitious reforms.

Need to know: business

Microsoft briefly overtook Apple as the companies vied to be the world’s most valuable business. Microsoft’s market value has hit $2.9tn thanks to the boom in artificial intelligence.

UK luxury group Burberry cut its full-year profit forecast following weak Christmas sales, echoing other big names such as Richemont and LVMH that have warned of falling demand.

Chesapeake and Southwestern will merge in a $7.4bn deal to create the biggest US gas producer.

US artificial intelligence companies including OpenAI have been engaged in secret diplomacy with Chinese AI exports amid shared concerns about the spread of misinformation.

Boom times lie ahead for the UK scrap metal industry as steel production goes green with giant shredders that can chew through 400 tonnes of material an hour. Global demand for steel scrap is projected to surge by 2050 as steel decarbonisation gathers pace.

The FT Magazine reports on how young people were lured by the promise of jobs at the “cutting edge” of AI in Nairobi but were left sifting through the internet’s worst horrors as social media moderators with few labour rights.

Science round-up

The European earth observation agency confirmed that 2023 was the hottest year ever, with “climate records tumbling like dominoes” as the global average temperature reached almost 1.5C above pre-industrial levels.

The mission that was to have returned the US to the Moon for the first time in 50 years appeared to be over after a failure in the propulsion system resulted in a “critical loss” of fuel.

The Asia space race is also heating up. Chinese start-up LandSpace Technology plans to launch reusable rockets in 2025, in a similar approach to SpaceX, while India aims to begin a series of flight tests for an eventual crewed space flight in 2025.

Aarti Holla-Maini, new director of the UN Office of Outer Space Affairs, told the FT that governments and industry should speed up attempts to deal with the growing problem of “space junk”.

Millennia-old migration patterns explain why some Europeans are more at risk than others from a range of diseases including multiple sclerosis and Alzheimer’s, according to groundbreaking genomic research.

Those of you have seen the TV series The Last of Us will be familiar with the concept of killer fungi. Scientists are now warning that fungicides applied to agricultural crops are contributing to a rising death toll from fungal infections by encouraging drug-resistant strains.

Scientists have genetically engineered microbes with the potential to develop a vast range of new products from drugs to detergents and household plastics in the latest advance in synthetic biology.

The Antarctic seal is the latest species to be hit by a virulent strain of avian flu as the virus jumps from birds to wild animals, increasing concerns it will adapt to infect mammals and humans more easily.

How would you feel about using an AI death calculator? Academics using Danish data on education, salary, job, working hours, housing and doctor visits have developed an algorithm that can predict a person’s life course, including premature death.

Some good news

A landmark UK study showed expanded genetic profiling could lead to breakthroughs in cancer diagnosis and therapy for common tumours. The research has highlighted the UK’s role as a global pioneer in genome sequencing.

Thanks for reading Disrupted Times. If this newsletter has been forwarded to you, please sign up here to receive future issues. And please share your feedback with us at disruptedtimes@ft.com. Thank you

[ad_2]

Source link

Comments are closed.