[ad_1]

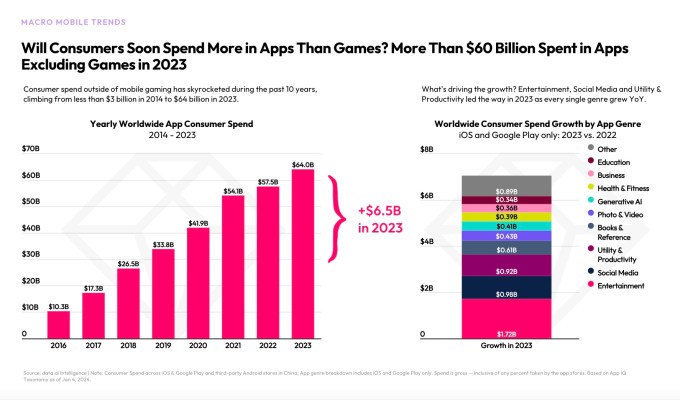

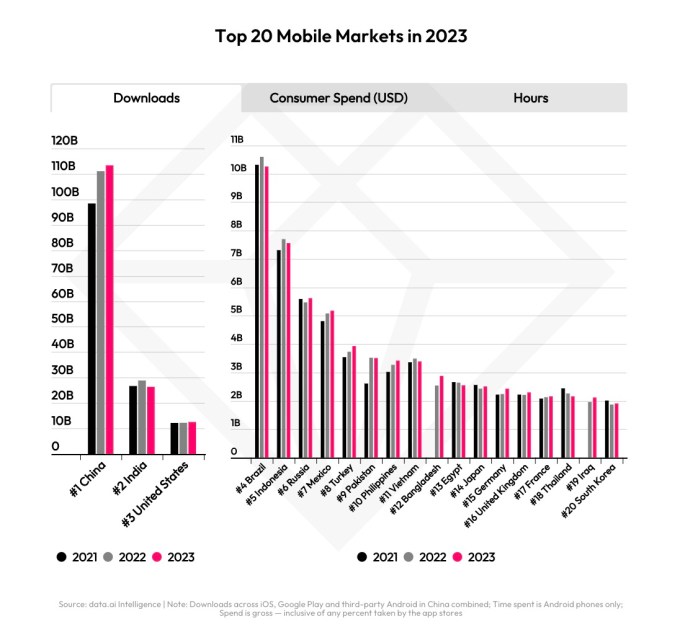

After the app economy slowed for the first time ever in 2022, things picked up pace again over the past year. According to app intelligence provider data.ai’s annual “State of Mobile” report, out today, consumer spending on apps saw a modest 3% increase year-over-year in 2023 to reach $171 billion across the App Store, Google Play, and third-party Android app stores in Chiana. A growing part of that total consumer spend came from apps, not mobile games, thanks in part to TikTok’s success. However, app downloads remained flat last year at 257 billion, up only around 1% year-over-year.

In 2022, the nonstop growth of the app economy had finally a snag in a post-Covid slump as consumer spending normalized and a down economy saw more people tighten their wallets. Back-of-the-napkin math even suggested that consumer spending may have slowed on Apple’s App Store as well, but it was not possible to come up with exact figures because Apple’s cut of transactions is no longer a flat 30% across the board.

Last year, things were once again moving in a positive direction, data.ai found.

Consumer spending on non-game apps grew 11% year-over-year in 2023 to reach $64 billion. Social apps and the creator economy drove this growth with TikTok helping to lead the way. Last year, the short-form video app hit a new milestone of more than $10 billion in lifetime spending, for instance, becoming the first non-game app to do so. This year, data.ai predicts that consumer monetization in social apps will grow 150% to $1.3 billion.

Image Credits: data.ai

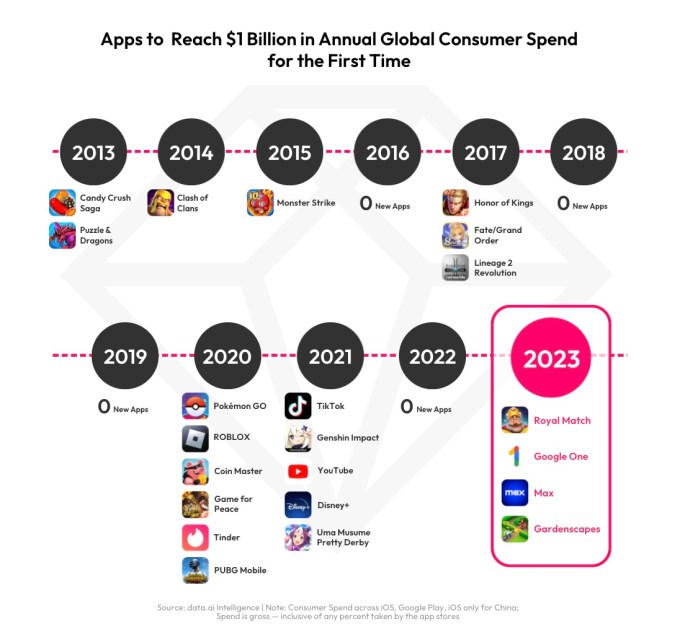

Elsewhere, more than 1,500 apps and games generated over $10 million annually in 2023, while 219 surpassed $100 million and 13 surpassed $1 billion. Four new apps reached $1 billion in the year, including Royal Match, Google One, Max, and Gardenscapes.

Image Credits: data.ai

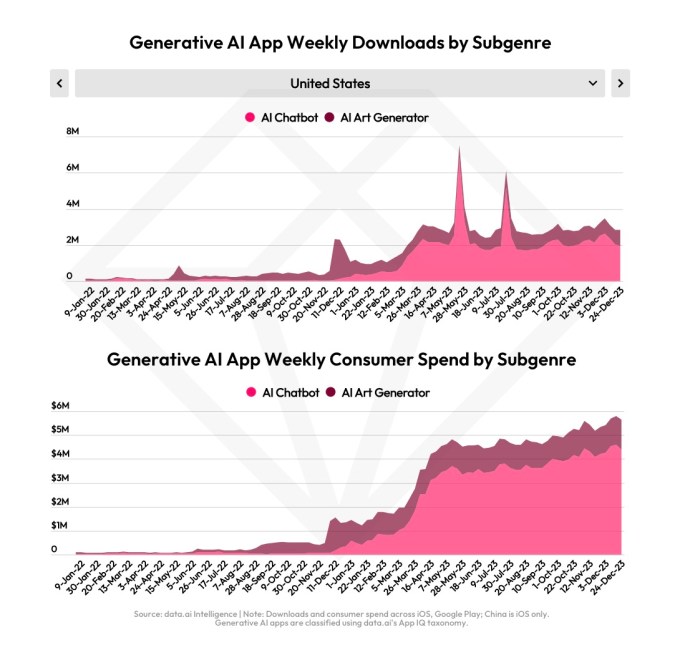

The firm also cited generative AI advances as helping to fuel consumer spending last year. The genAI app market expanded by 7x, leading to new consumer experiences like AI chatbots and AI art generators. Top apps included ChatGPT, Ask AI and Open Chat, in terms of consumer spend. Data.ai noted that AI app popularity was “fairly global,” but the genre didn’t rank among the breakout genres in China, Japan, Saudi Arabia and Turkey.

Image Credits: data.ai

To capitalize on consumer demand, more than 4,000 apps added the word “chatbot” to their app descriptions, and more than 3,500 added “gpt,” data.ai found. In addition, 2,500 apps launched in 2023 with “chatbot” in their description — which the firm says is nearly double the apps launched in the previous four years combined.

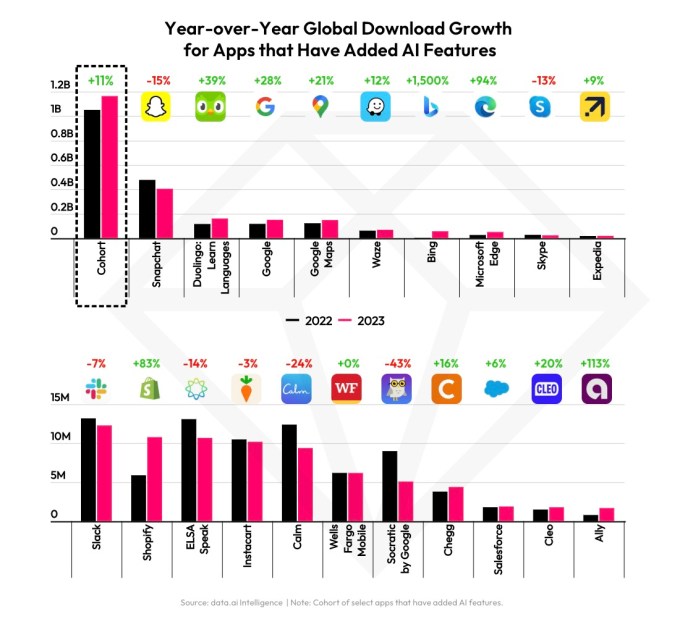

Outside of AI apps themselves, other apps adopting AI features also did well in 2023.

20 apps that added such features saw 11% year-over-year growth in downloads, data.ai found. 13 of the 20 (65%) also saw positive growth.

Image Credits: data.ai

The full report also delved into other metrics of app ecosystem health, including installs, time spent, ad spend, gaming-specific details, and more.

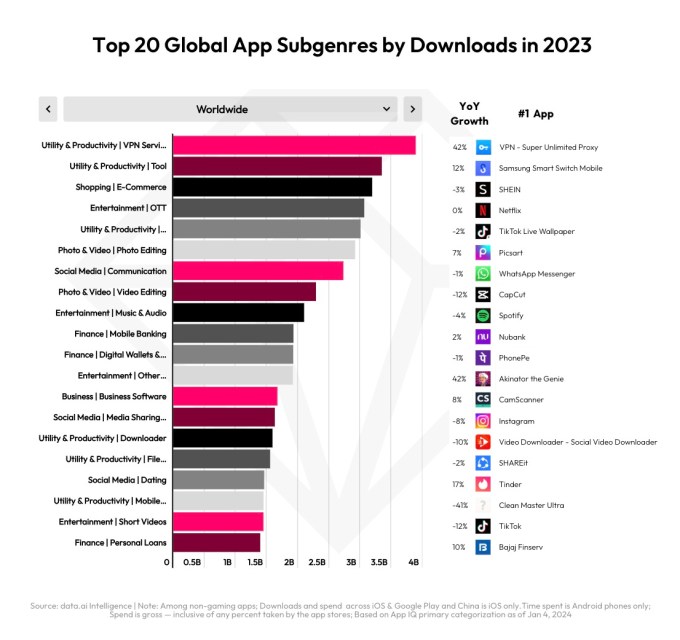

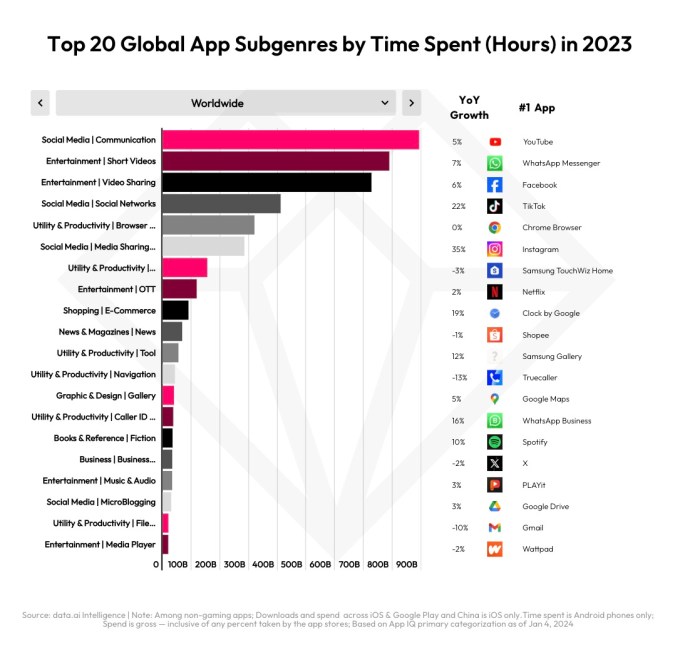

Last year, China led India (No. 2) and the U.S. (No. 3) in app installs, while Bangladesh emerged as the fastest-growing market. To subgenres for apps included things like utilities, productivity apps, shopping, entertainment and photo and video.

Image Credits: data.ai

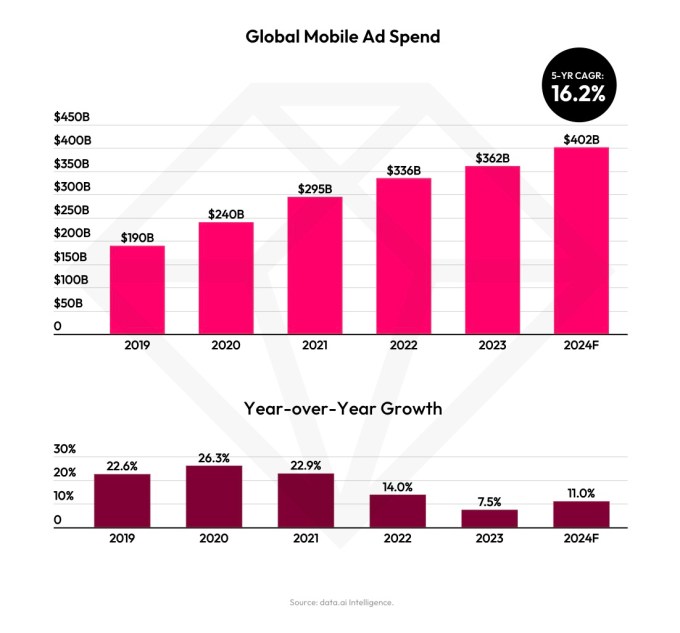

Data.ai also reported hours spent peaked at 5.1 trillion, up 6% year-over-year, while mobile ad spending is projected to reach $362 billion this year, up 8%. The forecast for 2024 will see a larger jump of 16.2% to reach $402 billion, data.ai estimates, as ad spending bounces back from slower growth in 2023.

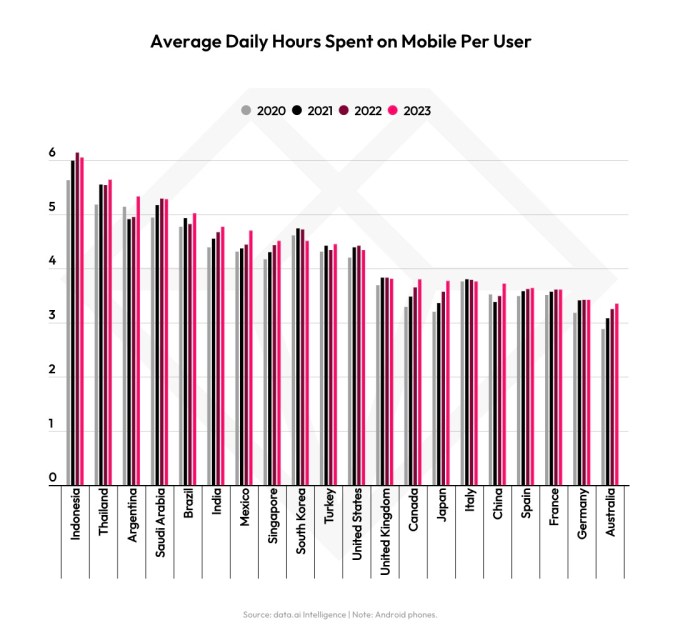

Meanwhile, across 10 top markets, the average daily hours spent on mobile per user grew 6% from 2022 to reach more than 5 hours. Here, apps like YouTube, WhatsApp, Facebook, TikTok, Chrome, Instagram, Netflix and others helped boost time spent.

Image Credits: data.ai

Image Credits: data.ai

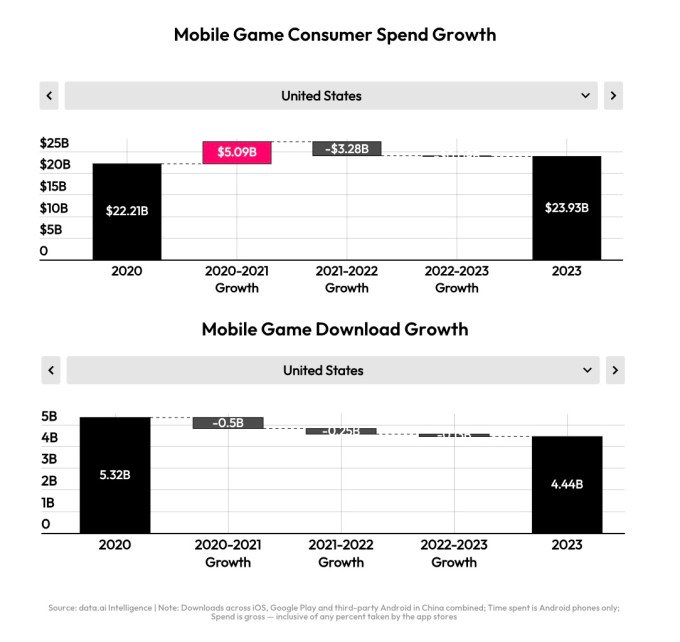

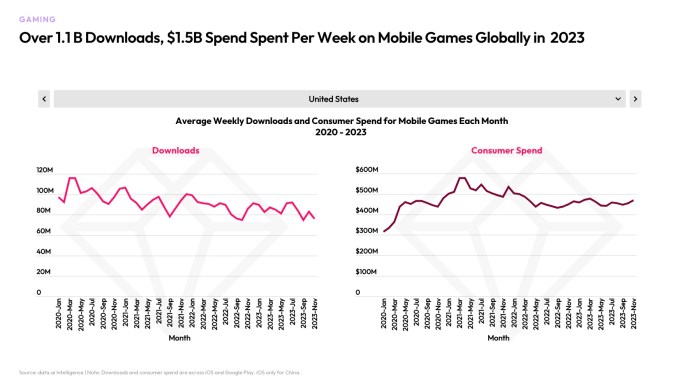

Mobile gaming, however, did not far as well in 2023, with spending down 2% year-over-year to $107 billion. Gaming downloads were roughly in line with prior years, accounting for 88 billion out of the 257 billion total downloads. Top genres included Hypercasual, Simulation, and Action. Among the breakout games in the year were Monopoly GO and EA Sports FC Mobile Soccer. In another milestone, Genshin Impact crossed $4 billion in lifetime spending. Games like Block Blast Adventure Master and Attack Hole drove downloads, amid surprise hits like Avatar Life. Gacha Life 2 and Eggy Party also made big gains in downloads and usage.

Image Credits: data.ai

Image Credits: data.ai

Other 2023 trends saw Chinese shopping apps like Temu and Shein growing 140% as they reached Western markets, while social and entertainment apps’ time spent grew 12% to 3 trillion hours. The latter also saw spending grow 10% to $29 billion.

Post-pandemic trends also continued as travel app downloads grew 13%, driven by travel services (26%), tour booking (80%), and flight booking (43%). Similarly, ticketing apps jumped 31%, thanks to big concerts by Taylor Swift and Beyonce — an increase of 66% from pre-pandemic levels.

The full report breaks down top apps and games by country across metrics like installs, spending, and time and delves deeper into individual sectors like finance, retail, video streaming, social, food & drink, travel, health & fitness, sports, and more.

Worldwide, the top app by installs and spending was TikTok, but Facebook remained No. 1 by time spent. The top games were Subway Surfers (downloads), Candy Crush Saga (spending), and Roblox (monthly active users).

Image Credits: data.ai

Image Credits: data.ai

[ad_2]

Source link

Comments are closed.