[ad_1]

More construction projects are being started, but payments to contractors and their subcontractors continue to cause a bottleneck in the normal course of completing a project.

“Banks are more and more careful with their own funding of development projects, which means they will also slow down payments on their own side,” Constrafor CEO Anwar Ghauche told TechCrunch. “What this means is that payment timing to subcontractors are extending instead of shrinking, only getting more difficult for subcontractors because they don’t usually have recourse to go to their banks and grow their line of credit.”

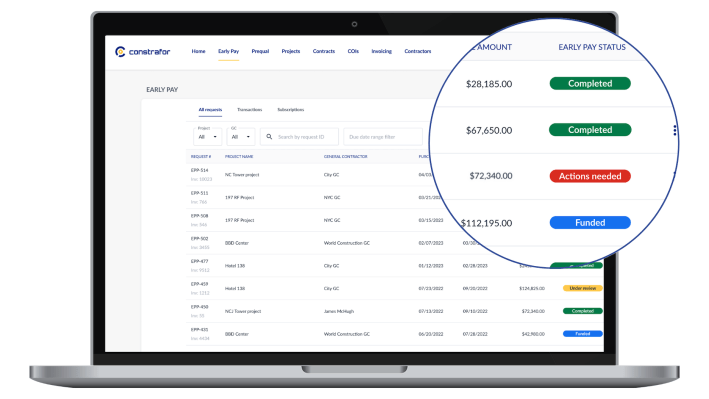

Ghauche and Douglas Reed started Constrafor, a SaaS construction procurement platform, to provide embedded financing and software for general contractors to manage their subcontractor workflow. Its Early Pay Program assumes the risk for the subcontractor invoice, freeing up cash flow and reliance on traditional and costly lending options. The general contractor then reimburses Constrafor for the invoice.

The company raised $106.3 million in equity and debt in 2022, and since then, Constrafor has grown from 15,000 customers to 23,000. Ghauche admits that the company “had a hiccup on revenue” during this time, but that it didn’t have anything to do with the credit market or network. Since then, the company tweaked its credit origination and is now growing at 25% month over month this year “in sustainable growth.”

Constrafor also joined in on the AI trend by launching some initiatives using embedded generative AI related to automating manual reviews, for example, of insurance. It also partnered with Stripe to offer a banking product and now has over 80 companies banking with them.

Now Constrafor is back with another cash infusion of $7.5 million via a SAFE note, led by Motive Partners, that closed this month. New investor Fifth Wall joined existing investors, including FinTech Collective, Clocktower Technology Ventures, Commerce Ventures, FJ Labs and NotreVis, in the round. This gives the company $14 million in equity and $100 million in debt raised since the company was founded in 2019.

Anwar Ghauche, CEO of Constrafor. Image Credits: Constrafor

When asked why Constrafor went after a SAFE note versus a priced round, Ghauche said he didn’t think the market “was great today in terms of pricing.”

“We’ve seen that deterioration in the multiples for fintech companies,” Ghauche added. “We found that this is a much better way for us to keep growing, hence our milestones on the revenue side for the Series A, so we’re targeting to cross $5 million ARR before we actually go for a Series A. If we can be at $10 million ARR, that will be better.”

In addition, the investment includes access to a credit facility with Apollo. That potential for additional capital gives Constrafor “scalable credit and capital for our business,” Ghauche said.

And at a time when other financial players are increasing rates due to the difficult economic environment, Constrafor is able to lower its price to customers and pass on the savings to them, he added.

Meanwhile, the new capital will be used for payroll and to fund operations. Ghauche intends to get its EarlyPay program rated and open up Constrafor’s APIs to general contractor customers.

“We’re seeing quite a bit of construction startups coming up now, and we feel we have a pretty large network right now, so we want to open up our platform for these companies to connect to ours and build on top of Constrafor,” Ghauche said.

[ad_2]

Source link

Comments are closed.