[ad_1]

This article is an on-site version of our Unhedged newsletter. Sign up here to get the newsletter sent straight to your inbox every weekday

Good morning. For two hours yesterday, Jay Powell grimaced through senators’ harangues, some of which were even related to monetary policy. But the only news came in his opening statement:

The latest economic data have come in stronger than expected, which suggests that the ultimate level of interest rates is likely to be higher than previously anticipated. If the totality of the data were to indicate that faster tightening is warranted, we would be prepared to increase the pace of rate hikes.

Markets took this as Powell putting 50 basis point tightening increments back on the table. The two-year Treasury yield shot up 12bp, taking it above 5 per cent for the first time since 2007. Stocks sold off.

This is an important change from Powell, because it suggests the Fed’s view of data-dependence is shifting. He has been emphasising the ultimate resting place of rates while downplaying the significance of how long it takes to get there. Now, after a clutch of hotter economic data, he is saying pace matters again.

The advantage of taking increases 25bp at a time is optionality. Until recently, the data has been confusing, and with 400bp of tightening hitting the economy on a lag, it made sense not to rush. Yet if the economy really is hotter than we thought, stopping inflation from becoming ingrained in expectations is, in the balance of risks, more pressing.

That “if” remains an open question. As Powell mentioned yesterday, stronger January data was probably skewed by a very warm winter in the north-east (a fifth of the US economy). The jobs report on Friday and consumer price index next Tuesday will decide the Fed’s next move. But markets have already rendered their verdict. After Powell spoke, the market-implied probability of a 50bp rise this month rose from 30 per cent to 70 per cent.

Email us: robert.armstrong@ft.com and ethan.wu@ft.com.

Revaluing the software industry

The US software industry is extremely big and important. Just the 10 largest companies have a market capitalisation of $2.9tn — about 7 per cent of the stock market. Microsoft alone accounts for $1.9tn of that.

The way these companies pay their employees and report their results makes them look (to many investors, at least) more profitable than they really are. Many software stocks had a brilliant run between the end of the great financial crisis and the beginning of the pandemic, as investors went all-in for growth. That is changing now, and the industry’s finances may be in for a reassessment. The implications for stock prices are obvious.

The illusion of extraordinary profitability is the fact that software companies pay their employees largely in stock. Many companies report adjusted profits excluding this form of pay. This is insane, for reasons we detailed yesterday.

It is important to understand that this is an industry-wide issue. Mark Moerdler of AllianceBernstein calculates that over the past 10 years, as the good times have rolled, share based compensation has risen from 4 per cent to almost 12 per cent of revenue for global software companies, on average (median). In an industry with operating margins of 30-40 per cent, that means excluding SBC pumps up operating margins by as much as a third. At younger companies, the figure can be much higher: at Snowflake, a $45bn cloud software company, SBC was 42 per cent of revenue last year — all excluded from adjusted profit.

Established companies are not immune. Adobe has spent $13.5bn repurchasing 31mn of its own shares over the past three years. Over that period, the company share count has fallen by only 21mn shares. Billions in value are leaking out of Adobe every year to pay for something the company (insanely) excludes from adjusted profits.

But at companies that do not adjust away SBC, its mere presence makes their results harder to follow. Microsoft is a good example, as we argued yesterday. The point is worth repeating. The company spent $33bn repurchasing 95mn of its own shares last year, but it issued 40mn shares to give to employees. In other words, the company spent something like $13bn of its free cash flow — about a fifth of the cash it generated last year — paying employees.

Anyone who is valuing Microsoft (or other software companies) on cash flow and who doesn’t take the (considerable!) trouble to adjust for SBC is making a mistake. And to the degree that unadjusted cash flow drives software companies’ stock prices, the whole sector may be overvalued relative to other industries.

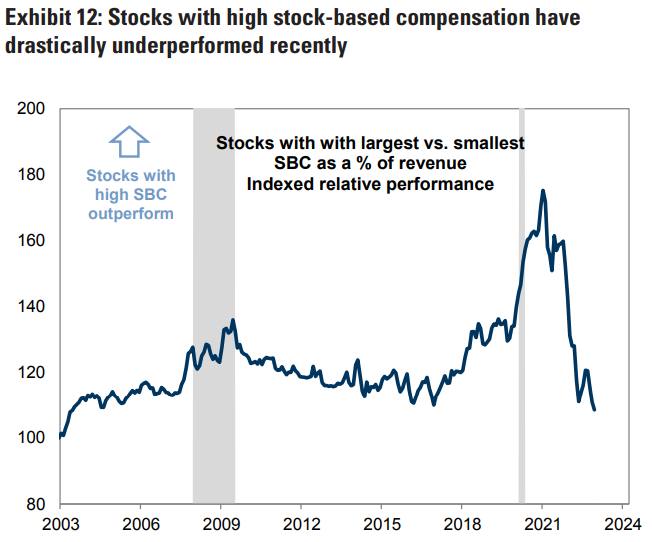

In a note to clients last week, Ryan Hammond’s team at Goldman Sachs wrote that the difference between adjusted and unadjusted earnings is far larger in software than in any other sector. They expects that “the market backdrop will remain challenging for stocks with high SBC and low GAAP margins” as higher rates increase the focus on real profitability. Here is their chart of the relative performance of the top and bottom quartile of the stock market companies, ranked by SBC as a percentage of revenue:

Companies that exclude SBC from adjusted earnings should stop doing so; it’s a shameful practice. And investors should be especially watchful of software companies that buy back a lot of shares. These companies tout buybacks as “returning cash to shareholders”, but a big chunk of the cash often goes to employees instead.

More on inflation targeting

Readers had much to say on Monday’s discussion of the Fed’s inflation target.

Several wrote in to argue the Fed ought to consider replacing its fixed 2 per cent target with a target range. The Bank of Canada already does something like this; officially it tries to keep inflation “at the 2 per cent midpoint of a target range of 1 to 3 per cent”. One reader at a financial research shop wrote that a range could help the Fed cope with structurally inflationary forces:

Powell and former vice-chair [Lael] Brainard keep bringing up the loss of 3.5 million workers due to Covid (early retirement and deaths) . . .

San Fran Fed President Mary Daly’s comments over the weekend lean in a similar direction. She mentioned how global price competition is declining and how the transition to a ‘greener’ economy will also require more investment. Both would mean higher inflation for longer.

It wouldn’t surprise me if the central bank were to shift to an inflation target range, say like 2% to 3%, when it gets close. That way, it gives the Fed an out without completely destroying economic output.

Target ranges are more commonly used by emerging market central banks, such as South Africa, which shoots for 3 to 6 per cent inflation. These looser ranges are meant to create credibility in the face of more volatile EM inflation, another reader, Bruce Hodkinson, pointed out. If advanced-economy inflation starts behaving more like EM inflation, a range seems sensible enough.

Other readers proposed a return to tradition — namely, the sorts of “intermediate” targets used by central banks in the 1980s. These focus on variables indirectly related to the central bank’s ultimate goals. Canonically, it means targeting the money supply, but some propose targeting nominal gross domestic product too. Thomas Mayer of the Flossbach von Storch think-tank had an interesting suggestion:

Today, monetary targeting is of course out of fashion (though neglecting money was probably a mistake, as the recent BIS-study shows). But the [old] Bundesbank approach could be calibrated to the mainstream economics of today by pursuing minimisation of the output gap [ie, how far current growth is from its highest sustainable level] as the “intermediate target” and leaving 2 per cent inflation as the ultimate target to be achieved over the undefined medium-term.

Lastly, Roger Aliaga-Diaz, chief economist at Vanguard’s in-house think-tank, made the important point that the Fed is not acting in a vacuum. All things equal, a higher US inflation target would weaken the dollar, reflecting lower US purchasing power. But because of the dollar’s reserve currency status, the spillover effects could be profound:

Beyond the academic debates on whether 2% target is the right target or not, policymakers cannot neglect the practical implications of moving the goalposts because of a) credibility issues (as you discuss in your column), and b) because that target is really a foundational pillar of (implicit) global monetary policy co-ordination.

On the latter, all major central banks that have adopted inflation targeting have coalesced around the common 2% goal. This is not a coincidence. In a post Bretton Woods world of flexible exchange rates and mostly free capital mobility, harmonisation of long-term average inflation rates (ie targets) is required. So, changing the inflation target by the Fed would require massive international co-ordination with other major central banks, requiring unanimous agreement. A unilateral move could also trigger widespread accusations of starting a new currency war (remember when QE was introduced) by policymakers from emerging markets, etc. It’d be really messy.

Messy indeed. (Ethan Wu)

One good read

How is China going to pay off all its debt? Stiffing street sweepers, for one.

[ad_2]

Source link

Comments are closed.