[ad_1]

Good morning. This article is an on-site version of our FirstFT newsletter. Sign up to our Asia, Europe/Africa or Americas edition to get it sent straight to your inbox every weekday morning

Russia is to halt the flow of gas to Poland and Bulgaria from today, according to authorities in both EU nations, as Moscow steps up efforts to weaponise energy supplies following its invasion of Ukraine.

PGNiG, the Polish state-controlled gas group, said yesterday that Russian supplier Gazprom had informed it of a “complete suspension of supplies” under its Yamal contract effective from 8am Polish time.

Late yesterday, Bulgaria’s energy ministry said Gazprom had told its state gas company, Bulgargaz, that it would halt gas supplies. Sofia said it had taken steps to find alternative arrangements for natural gas supply.

The spat between PGNiG and Gazprom is the first test in the stand-off over rouble payments for Russian gas supplies, and suggests Moscow is willing to cut off a source of billions of dollars of revenue.

Warsaw also wants EU allies to agree new powers to make it easier for sanctions-hit Russian assets, including property, to be seized and sold to help cover the vast costs of rebuilding Ukraine after the war.

Have you been affected by rising European gas prices? Share your experience with me at firstft@ft.com. Thanks for reading FirstFT Europe/Africa — Jennifer

The latest from the war in Ukraine

-

Military aid: Germany has agreed to allow exports of heavy weaponry to Ukraine, a U-turn that followed weeks of pressure on Olaf Scholz’s government.

-

Food security: Disruption to Ukraine’s agriculture industry has upended the European breadbasket. Take a look at how with our interactive.

-

Oil: EU member states are considering a cap on the price they would pay for Russian oil to hit Kremlin revenues while avoiding a total embargo.

-

Sanctions: Switzerland has mirrored all the US and EU sanctions against Russian oligarchs. But it has frozen only $8bn of assets. Why?

-

Russia’s warning: The nation’s security council secretary warned that Ukraine will “break up into several states” if the west does not end its support for Kyiv.

-

Opinion: The war, which is causing a many-sided economic shock, is in sum a multiplier of disruption in an already disrupted world, writes Martin Wolf.

Five more stories in the news

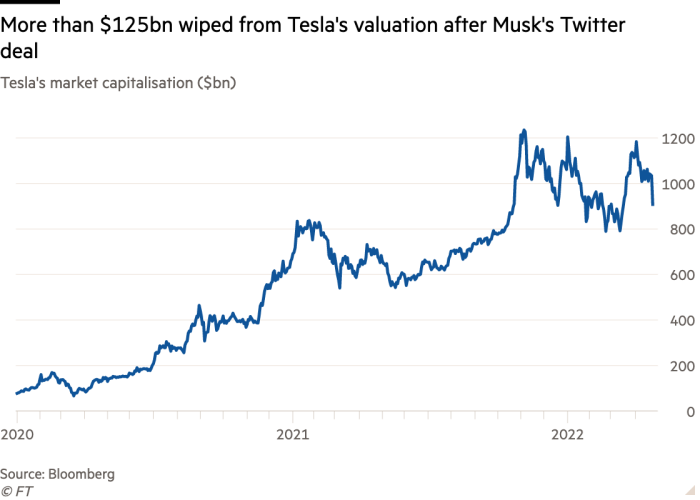

1. Elon Musk can walk away from Twitter deal using $1bn break fee The Tesla chief executive can walk away from his $44bn takeover of the social media platform for a significantly lower penalty than in the typical leveraged buyout, a regulatory filing by Twitter yesterday revealed.

-

It’s not all good: Tesla shares slid more than 12 per cent yesterday, wiping more than $125bn off its valuation, which could pose problems for Musk’s margin loan secured against his stake in the electric carmaker.

-

In Nigeria: Users fear that the less politically progressive stance of Twitter’s new leadership will affect their freedom of speech. (Al Jazeera)

2. Boris Johnson threatens to privatise public bodies The UK prime minister said bodies including the Passport Office and the Driver and Vehicle Licensing Agency could face privatisation unless they sorted out significant backlogs, accusing the agencies of falling victim to a “post-Covid mañana culture”.

3. UBS’s best first-quarter profits in 15 years Traders propelled the Swiss bank to its best first-quarter performance since 2007 as gains by volatile markets made up for lacklustre performance by its wealth managers.

4. Top US bank investors refuse to back climate proposals Investors refused to back resolutions demanding stricter fossil fuel financing policies at three big Wall Street banks yesterday, in a blow to environmentalists hoping to apply more pressure to lenders over climate issues.

5. Cabinet split on plan to cut UK food tariffs Tensions have broken out among senior Tories over a plan to unilaterally cut tariffs on food imports after the price of groceries in the UK rose 5.9 per cent in the past year.

The day ahead

Liz Truss to call for pressure on Vladimir Putin In a keynote foreign policy speech at London’s Mansion House, the UK foreign secretary will push for reform to a global security architecture that has failed Ukraine.

Results Boeing, Credit Suisse, Deutsche Bank, GlaxoSmithKline, Mattel, Mercedes-Benz, Meta, Puma, and Spotify are among the companies reporting earnings today. More in our Week Ahead newsletter.

Madeleine Albright’s funeral President Joe Biden is set to speak at the funeral of the first female US secretary of state, who died last month at the age of 84. Read the FT’s obituary of Albright here. (CNN, FT)

Anniversaries It will be a day of commemorative events, as South Africa marks when the date when Nelson Mandela was elected president in 1994. Sierra Leone celebrates 61 years since independence and Israel observes Holocaust Martyrs and Heroes Remembrance Day.

Join us along with leading figures from Tesla, Volkswagen, Ford Pro, Nissan, Mercedes and Vauxhall at the Future of the Car event on May 9-12. Register here.

What else we’re reading

ECB opens door to July rate rise Christine Lagarde has spent days persuading investors that the European Central Bank will take a more “gradual” approach than the Federal Reserve to fight inflation. But that has not stopped markets pricing the possibility of its first rate rise in a decade as soon as July.

It’s time to reform Britain’s non-dom tax regime Wealthy residents being allowed to shelter overseas earnings from British tax is not a phenomenon of today’s globalisation — it dates back to 1799. Comprehensive reforms to modernise the non-domicile regime are long overdue, writes our editorial board.

Berkshire Hathaway needs to be broken up When Warren Buffett leaves his post after more than 50 years at the helm, no one else will be able to run the company as successfully as he has. The behemoth conglomerate should be broken up, argues Francine McKenna, editor of The Dig.

Don’t let Heathrow puncture the travel ‘bubble’ The travel industry is back in business. Yet Britain’s busiest airport wants to act as party pooper, arguing yesterday that the rebound was “temporary”. Its pessimism stands out, writes Cat Rutter Pooley.

How to avoid a recession A paper by Alex Domash and Larry Summers pointed out that, since 1955, there have been eight instances where US wage inflation was above 5 per cent and the unemployment rate was below 4 per cent, as they are now. In all eight, a recession followed within two years. History is not destiny, though, writes Robert Armstrong in our Unhedged newsletter. Sign up to receive it here.

Fashion

Women’s style during Britain’s horseracing season gets a lot of attention, often of the negative kind. But what of men? From tailored separates to merino shirts, here are winning looks for Ascot.

Thank you for reading and remember you can add FirstFT to myFT. You can also elect to receive a FirstFT push notification every morning on the app. Send your recommendations and feedback to firstft@ft.com. Sign up here.

[ad_2]

Source link

Comments are closed.